[ad_1]

In Chinn and Ferrara (2024), we discover substantial explanatory energy for the 10yr-3mo, the three month charge, and the debt service ratio for German recessions (our evaluation we additionally coated Canada, France, Italy, Japan, Sweden, and UK). Our pattern prolonged as much as 2022M12 (utilizing spreads as much as 2021M12), as we had been uncertain about recession in 2023. With Germany in a potential slowdown, it’s of curiosity to contemplate what our mannequin would have predicted.

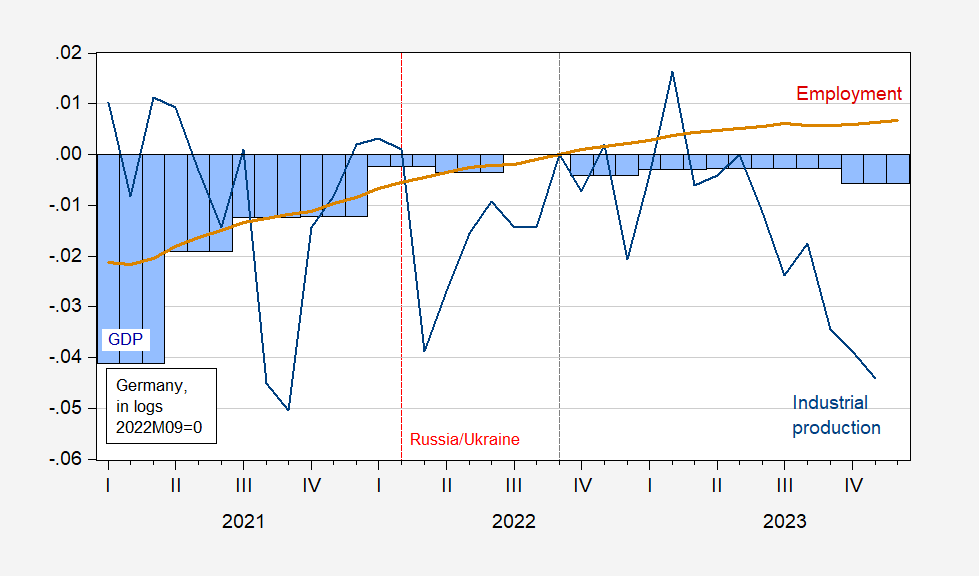

Determine 1: GDP in fixed euros (blue), industrial manufacturing excluding building (blue line), employment (purple line), all in logs, 2022M09=0. Supply: Eurostat, MEI by way of FRED, and creator’s calculations.

The final peak in GDP is at 2022Q3. Peak industrial manufacturing is February 2023, whereas employment has continued its rise, pausing at 2023M07. I tentatively set the recession begin date then. It’s essential to notice that neither the German Council of Financial Consultants, nor ECRI have established a peak, so that is an assumption on my half. (Laurent Ferrara supplies a chronology which extends as much as 2019, as described right here).

Suppose I estimate a probit regression over the interval as much as simply earlier than the expanded Russian invasion of Ukraine, i.e., 1985 to 2021M12 (utilizing the unfold, quick charge (i3mo), and debt-service ratio (dsr) as much as 2020M12) to estimate the year-ahead recession likelihood. The estimates are:

Pr(rec=1) = -4.85 – 60.6 unfold + 5.7 i3mo + 33.9 dsr

Pseudo-R2 = 0.32, Nobs = 430, Smpl for unfold, and so forth. 85M01-20M12. Daring face denotes significance at 10% msl.

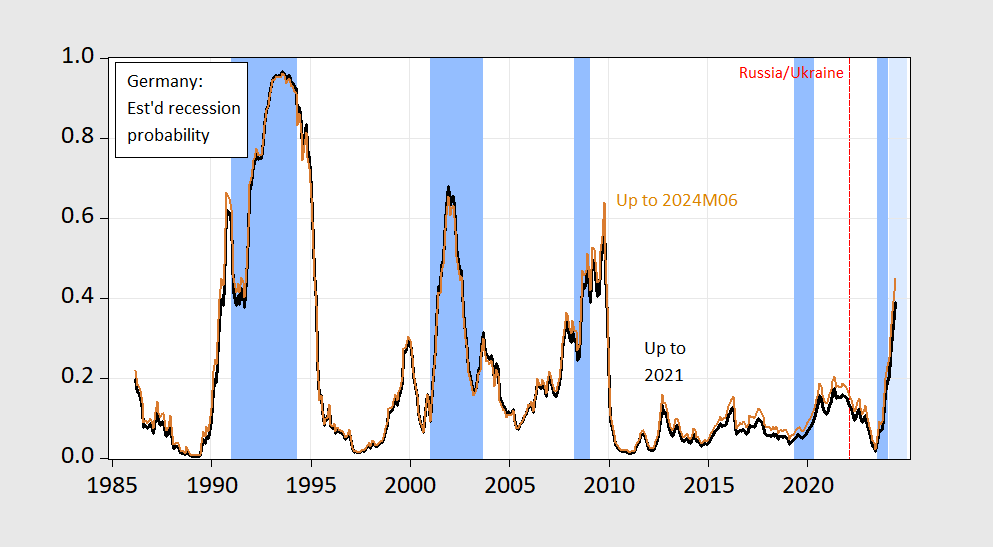

The estimates of recession possibilities are proven in black, with ECRI outlined recession dates shaded gentle blue, the place I’ve assumed final peak at 2023M07.

Determine 2: Estimated likelihood of recession utilizing probit fashions estimated as much as 2021M12 (black), estimated as much as 2024M01 (tan). ECRI outlined peak-to-trough recession dates shaded gentle blue. Supply: ECRI, creator’s calculations.

Word that the regression misses the 2020 pandemic recession, though the chances do rise from a really low stage. The likelihood of recession for 2024M01 is nineteen%.

Suppose I take advantage of your entire pattern interval as much as 2024M01 (and therefore the unfold and different determinants as much as 2023M01). Then one obtains the next estimates:

Pr(rec=1) = -4.05 – 59.7 unfold + 6.54 i3mo + 27.8 dsr

Pseudo-R2 = 0.29, Nobs = 455, Smpl for unfold, and so forth. 85M01-23M01. Daring face denotes significance at 10% msl.

The estimated possibilities for this regression are a lot the identical, with a barely larger likelihood for January 2024, at 23%.

In each circumstances, it doesn’t appear that the mannequin would predict a recession on the time they’re prone to have began. That being stated, no one has confirmed an ongoing recession in both Germany or the Euro space.

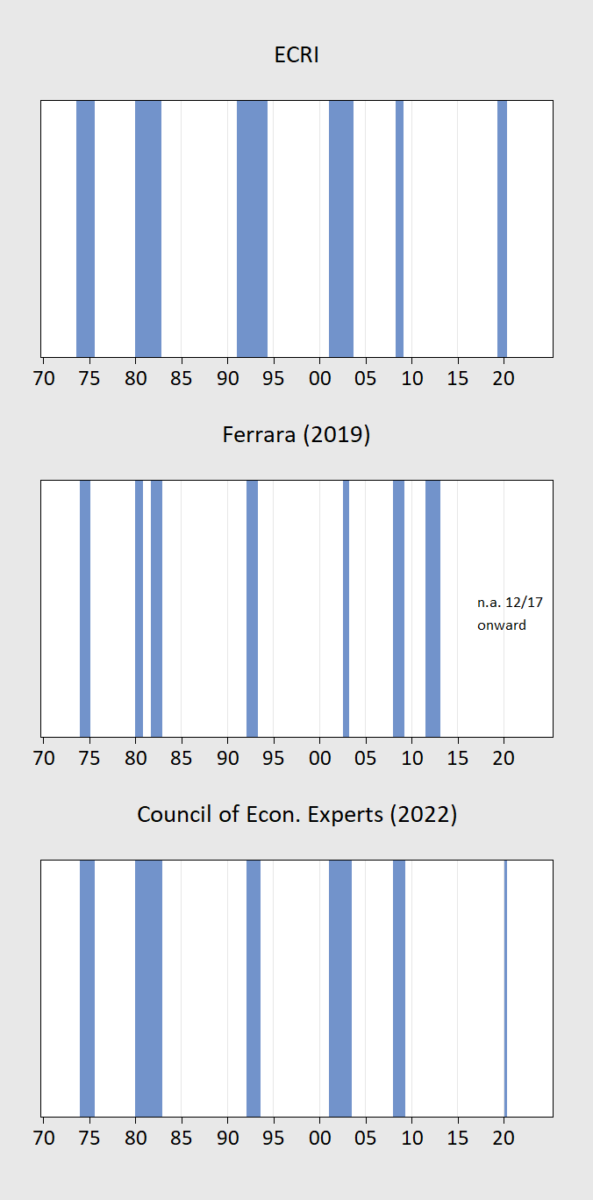

Word that there are totally different outcomes if one makes use of totally different chronologies, two of which (from Ferrara (2019), and GCEE (2022)) are proven under.

Notes: All recession dates peak-to-trough shaded gentle blue. Sources: ECRI, Ferrara (2019), German CEE (2022).

The solutions to each questions, then, are (1) perhaps, and (2) perhaps.

[ad_2]

Source_link